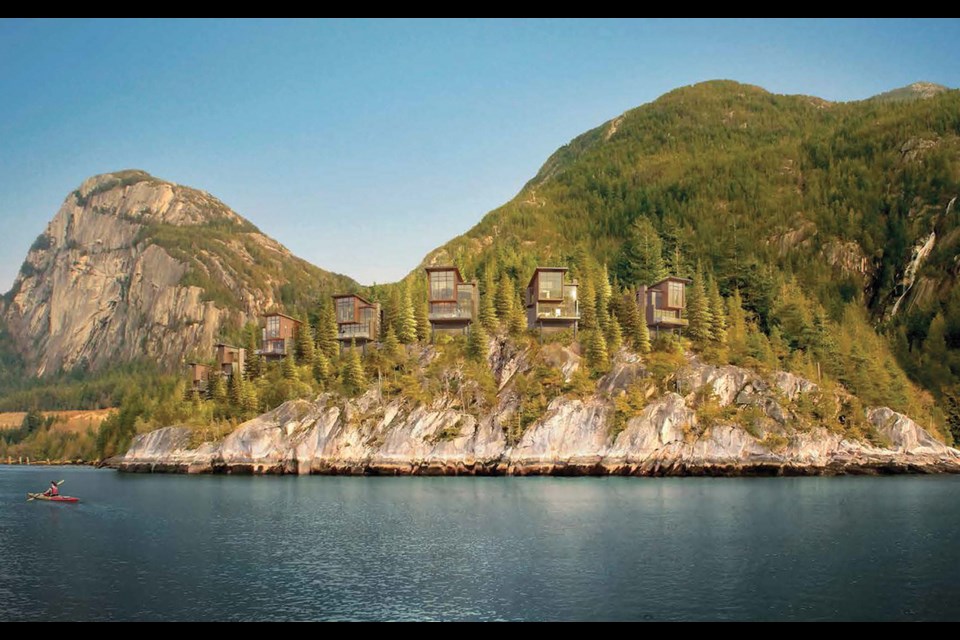

The $400-million Klahanie resort is moving ahead in 2017, according to its backer – but an investor in a previous version of the project still has unanswered questions.

The first plan for the 36-acre property, located across from Shannon Falls Provincial Park at the south end of Squamish, was introduced about a decade ago and one of the men behind the first incarnation has made another, more elaborate proposal.

Today, the plan is for Klahanie Resort, a reportedly $400-million, five-star destination resort, vacation homes, hotel, restaurant and spa. But that plan for the upscale resort is being called into question by an investor in the previous version.

Longshoreman Paul Spashett, who lives in the United Kingdom, says he invested about $200,000 in the original resort back in 2009.

The plan presented at the time was for 29 different buildings, including 165 hotel units along with 184 quarter-share condominium units, according to articles in The Chief at the time. It was then called the Shannon Falls Resort and Spa or Shannon Shores Resort and Spa, depending on the paperwork. Documents supplied to The Chief describe profit projections of up to 174 per cent in a limited partnership.

The expected date of return on the investment capital was late 2011 with the profits on the investment expected to come in late 2014.

Though Spashett says he was not kept up to date about what was happening with the development for years, West Vancouver’s Bahadur Karim, the current owner of the property, told The Chief the original investors will get their money back with the new development.

Karim told The Squamish Chief by phone recently that the original project was not viable at the time due to market conditions, but that when the new incarnation of the project goes forward those original investors will get their money back.

“The project got into difficulties when the market crashed in 2008,” he told The Chief.

Karim said that even though he was involved originally, he did not have full control of the companies in charge of the project, Klahanie Developments and Shannon Springs limited partnership.

In a BC Supreme Court affidavit by Karim from April 2011, Karim describes himself as “director and officer of Klahanie Developments.”

Karim said he now controls about 94 per cent of the project with his company Symphony Resource while the remaining percentage is held by the original investors.

“If there are any remnants from that time, I would be happy to buy anybody out,” he said.

Karim said there were “probably” about 27 original investors.

“I would say nothing is lost, in the sense of when the project takes off, everyone is going to benefit, including them, whoever remains,” Karim said.

They can either “get paid or stay,” Karim said, adding “if they are patient to wait it out.”

But Spashett hasn’t heard anything back about the development for two years, despite trying to make contact with the company.

“You just get the runaround,” he said, adding he tried to contact the current project’s design firm Ekistics, but no one returned his call.

He had not known how to contact Karim directly, he said.

Added twist

The story takes an added twist in that the U.K. financial management company Bentley-Leek Financial Management, which presented the proposal in 2009 to investors, was liquidated and two of its agents disciplined.

The United Kingdom Financial Conduct Authority (FCA) shut down Bentley-Leek Financial Management in 2013 for unscrupulous practices, including conflict of interest and advising clients to invest in projects known to be not viable. There is no suggestion the FCA considered the Klahanie project to have been one with questionable viability.

BentleyLeek was liquidated in 2011.

Two financial advisers with Bentley-Leek were fined by FCA a total $1.4 million and banned by the Financial Conduct Authority from holding any position at any financial firm. The men, Mark Bentley-Leek and Mustafa Dervish, were both directors of Bentley Leek Financial Management. Dervish came to Spashett’s home to pitch the Shannon Falls proposal, Spashett told The Squamish Chief.

“They were the agent,” Karim said of Bentley-Leek. “I don’t even know where they are or what happened.”

fear of lost investment

Spashett fears his investment is lost.

“It is very disappointing for me having invested, at the time, half of my [pension] investment fund,” Spashett said by phone from his U.K. home.

He was shocked to see that West Vancouver landowner Karim was again floating a massive resort project this year. “I would settle for my money back,” said Spashett. “I have worked in the mooring business for 37 years, never had a day off with sickness. Worked when I should have been in bed.”

The new project is on time and moving forward, Karim said.

“The market has turned up, the value has gone up. We have a super plan,” he told The Chief.

Karim said he is funding a feasibility study to see if the hydro lines that bisect the project can be moved.

“I wouldn’t be putting so much money out if I had doubts,” he said. According to Paul Fenske Ekistics, the design firm behind the current resort plans, the new incarnation of the upscale all-season resort is a go.

“The project is moving ahead after a summer on pause following the owner’s focus on family health issues,” Fenske told The Squamish Chief in an email. “We are moving forward with a study with BC Hydro to confirm the ability to move the transmission lines from their current location on the site. Once complete, we will be undertaking a development permit for submission to the District [of Squamish] by summer or fall 2017.”

The new project is going to be funded with “some bank financing, some presales and a lot of the cash that I will be making – now that I control 93 per cent, I will be injecting my own equity,” Karim told The Chief. “I am very confident of where it is going.”

Karim said that those original investors who are concerned can contact him directly.