After periods of rapid price appreciation over the past two decades, B.C. real estate is seeing less volatility and more stability, potentially indicating a new normal of balance in valuations and assessments.

Experts say many factors are contributing to a mixed outlook for home prices, including uncertainty related to exports, monetary policy and the efficacy of government affordability measures.

“Are we on a ledge, is there another peak, or are we at the beginning of a crevice? If I was ever that good at making those kinds of predictions, I’d have a better car,” said Andy Yan, director of the City Program at Simon Fraser University.

On one hand, positive returns are needed for the investors and developers who catalyze much-needed housing supply. On the other, subdued prices, if they transpire, could better align affordability levels with local fundamentals and incomes, he said.

In January, BC Assessment released a table highlighting residential price trends in individual markets. In the Lower Mainland, the results did not swing too far in either direction, with average assessments in various municipalities fluctuating less than two per cent from a year earlier.

“As I look at my property assessment … I open it up and it talks about how my current home went up by 20 per cent in 2022, and then this year it went down one per cent,” Yan said.

“It highlights, really, the complexities of how properties are valued in a place like Vancouver. This is really all about how it is a combination of not only supply but also demand and finance.”

Past two decades saw significant price gains

Home prices have seen several spikes over the past 20 years, said Brendon Ogmundson, chief economist with the British Columbia Real Estate Association.

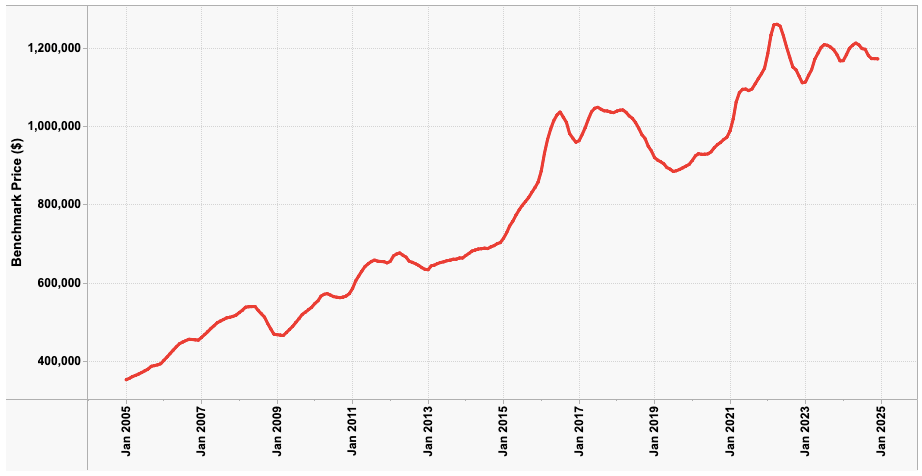

Before the global financial crisis of 2007-08, prices escalated significantly, with Greater Vancouver’s composite benchmark price rising 53 per cent from $351,600 in January 2005 to $538,800 in June 2008, according to the Canadian Real Estate Association (CREA).

Prices dipped following the financial crisis, to a benchmark low of $464,600 in March 2009, before spiking again around 2015 to 2017, according to CREA data. Greater Vancouver’s benchmark price was $713,100 in January 2015, and rose 47 per cent to $1,047,800 in July 2017.

A lot of blame was placed on foreign investors at the time, and while global capital certainly played a role, there were other contributory factors, Ogmundson said.

“It was right after Canada had experienced a significant shock to its economy from the collapse in oil prices,” he said. “It didn’t really affect B.C. very much, but it affected the Canadian economy and it affected monetary policy.”

The Bank of Canada lowered its overnight rate back to 0.5 per cent in July 2015, and mortgage rates went on to hit new lows, Ogmundson said. Meanwhile, the economy was doing better, job growth was very high and there was a dearth of supply, he said. With prices already rising, investors joined the fold, adding fuel to the fire.

“It was kind of a perfect storm of factors in 2015, 2016,” Ogmundson said.

There was a lull from 2018 to 2019 largely due to new stress tests for uninsured mortgages introduced by the Office of the Superintendent of Financial Institutions in January 2018.

The COVID-19 pandemic then brought another major price spike. CREA’s Greater Vancouver benchmark price rose 43 per cent from $883,700 in July 2019 to $1,259,900 in April 2022.

“During the pandemic we had completely shut off immigration, there were no foreign investors, there was not even any immigration,” Ogmundson said. “Without those factors we had record home prices and record home sales.”

The main drivers during the pandemic were largely on the demand side, he said, including record low mortgage rates, with five-year fixed mortgage rates below two per cent, in addition to considerable pent-up demand.

During this period, people were leaving their apartments in cities and looking for more spacious single-family homes in other areas of the province, coinciding with an already low amount of supply, he said.

“Not many people were willing to maybe put their house on the market during a pandemic, so we had an initial, pretty significant drop in listings and it didn’t really replenish,” Ogmundson said.

“That combination of overwhelming amounts of demand surging into a market that was really undersupplied, especially because the pandemic caused a lot of demand to kind of diffuse around the province, all of that demand was flooding into markets that were not prepared.”

Home prices face uncertain future

The CREA benchmark price for Greater Vancouver has roughly hovered around $1.2 million for the past three years.

Looking ahead, it is unclear where home prices may go in 2025, given the uncertainty surrounding both the possibility of a trade war with the U.S. and the length of the Bank of Canada’s current monetary policy easing cycle.

On the supply side, government leaders continue their focus on transit-oriented density and small-scale, multi-unit housing (SSMUH). On the demand side, there are federal restrictions on immigration, which could be further tightened by a potential Conservative federal majority.

Still, some momentum is expected from lower interest rates and population growth, and more time is needed for policy changes to play out, but a surge in prices seems unlikely in the short term.

“We haven’t had enough time pass with what I would describe as a fairly recent trend of prices stabilizing and so on,” said Andrew Lis, director of economics and data analytics with Greater Vancouver Realtors.

“I wouldn’t say enough time’s really passed for us to establish that as a new normal. It’s certainly a very real phenomenon at the moment that we are experiencing.”

Lis said it’s possible to see price growth in 2025, with Greater Vancouver Realtors forecasting modest appreciation of about four per cent overall in the market, and slightly less for the apartment segment.

Inventory levels will be key to the outcome, Lis said. His eye will be on the number of active listings. They are currently in the range of 13,000 to 15,000. In past periods defined by skyrocketing prices, active listings fell below 10,000.

“Perhaps by the end of 2025, if sellers don’t come to market in significant numbers with their properties over the course of 2025 and demand stays strong, there is a pretty decent probability that we end up in another low-inventory scenario,” said Lis. “Then all it really takes is that last ingredient of demand, and that’s how you get the rapid price escalation.”